2023: Changes to T4/T4A Reporting

For 2023, employers and pension plan administrators who issue T4 slips for wages and other remuneration paid or T4A Slips for Pension, Retirement, Annuity, and Other Income must report on a T4 or T4A slip whether, on December 31st of the taxation year, a payee or any of their family members were eligible to access dental insurance, or dental coverage of any kind, including health spending and wellness accounts, as provided by their current or former employer.

This reporting requirement is mandatory beginning with 2023 T4/T4A slips and will continue to be required on an annual basis. The Canada Revenue Agency (CRA) may reject any T4 or T4A slips that are filed without this information and may apply penalties.

This change is to support the introduction of the Canadian Dental Care Plan, which will provide dental coverage for uninsured Canadians with an adjusted family net income of less than $90,000 annually.

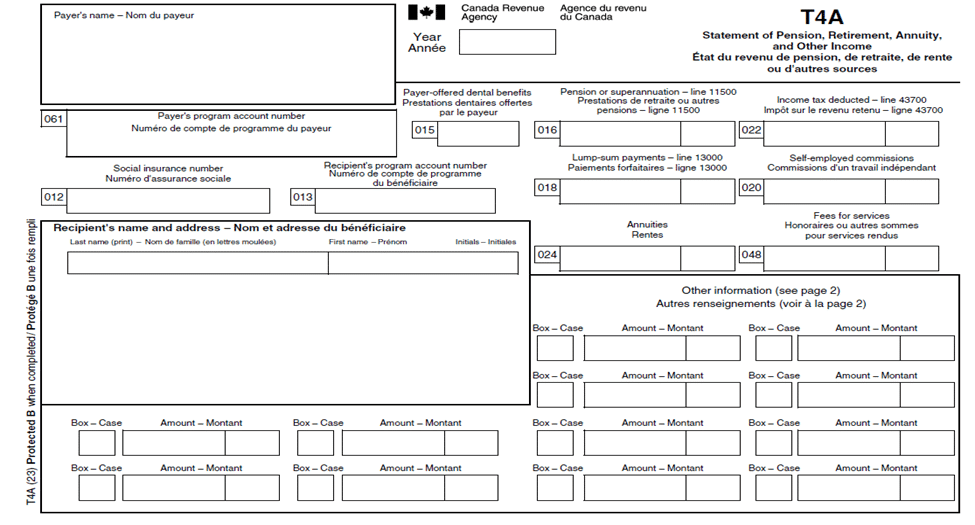

New Boxes on T4/T4A Tax Slips

T4

- Box 45: Employer-offered Dental Benefits

T4A

- Box 15: Payer-offered Dental Benefits. This new box will be mandatory if an amount is reported in Box 016, Pension or Superannuation. The box will otherwise be optional.

Codes

- Code 1: No access to any dental care insurance, or coverage of dental services of any kind.

- Code 2: Access to any dental care insurance, or coverage of dental services of any kind for only the payee.

- Code 3: Access to any dental care insurance, or coverage of dental services of any kind for payee, spouse and dependants.

- Code 4: Access to any dental care insurance, or coverage of dental services of any kind for only the payee and their spouse.

- Code 5: Access to any dental care insurance, or coverage of dental services of any kind for only the payee and dependants.

Key Phrases

Additional reporting is required for employees eligible to access dental care insurance “on December 31st of the taxation year“. Therefore, if the individual is a former or retired employee who is no longer employed by your company on December 31st, this box is not required to be completed.

The codes used are based on “access” to dental care insurance. Therefore, if an employee was eligible for dental benefits, even if they opted out of the coverage or did not make any claims in the year, Code 2-5 will apply as they still had “access” to coverage as of December 31st.

What to Expect for 2024

Effective January 1, 2024, there will be an enhancement to CPP contributions. CPP will now consist of two components:

- The first component on maximum pensionable earnings up to $68,500 in 2024, and

- The second additional component, which will be phased in between 2024 and 2025

The second additional component is a higher earnings limit that will apply to a higher portion of earnings under CPP. This is also called the additional maximum pensionable earnings for earnings between $68,500 and $73,200 for 2024. This ceiling is to increase every year after 2024.

Employees who earn more than the first earnings ceiling but less than the second earnings ceiling will contribute 4% of the amount they earn above the first earnings ceiling. Their employers will also contribute 4% on their behalf.

Beginning 2024, the new enhanced C/QPP contribution will be deducted from pay on earnings above $68,500 up to $73,200 per annum. For this purpose, the CRA has created two new boxes on the current T4:

- Box 16A – for reporting of employees’ second CPP contribution

- Box 17A – for reporting of employee’s second QPP contribution

This box will appear on your 2023 T4 slips but will remain blank since the second CPP contributions only begin on January 1, 2024.

Contact Ford Keast LLP in London to Discuss Changes to T4/T4a Reporting Requirements

Talk to our tax advisory team to discuss any specific questions you may have about how this may impact you or your business. At Ford Keast LLP, our accountants and tax advisors can provide services such as incorporating a company, maintaining books of accounts, and all other reporting requirements. To learn more about how Ford Keast LLP can provide you with the best accounting and tax expertise, contact us online or by telephone at 519-679-9330.